Unlock digitalization in banking that helps you

Deliver Imaginative

Experiences

with connected data, personalized rich moment elevation, and fast, seamless servicing

Design Solutions Ready

for Infinite Digital Plays

by simplifying connectivity, agility, speed, and abstracting away complexity

Realize Operational

Excellence

with faster, accurate and more transparent business operations

Create powerful business outcomes with innovative digital onboarding solutions

Speed up customer

digital channel adoption

Save operational

costs

Hypercharge

customer acquisition and retention

Reduce fraud

and leakage

Lead the market in

customer satisfaction

Drive decisions with

deep data visibility

The future of Banking is digital

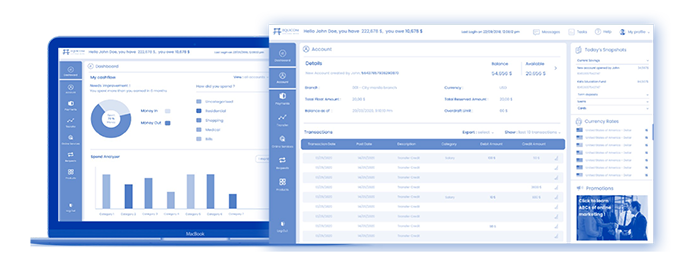

- Banking services via the web, mobile, and tablet devices.

- Single integrated view of customer’s profile, holdings, and interactions

- Integrated sales campaign and case management capabilities

- Automated loan origination cycle

- Advanced analysis technology to make timely and informed decisions

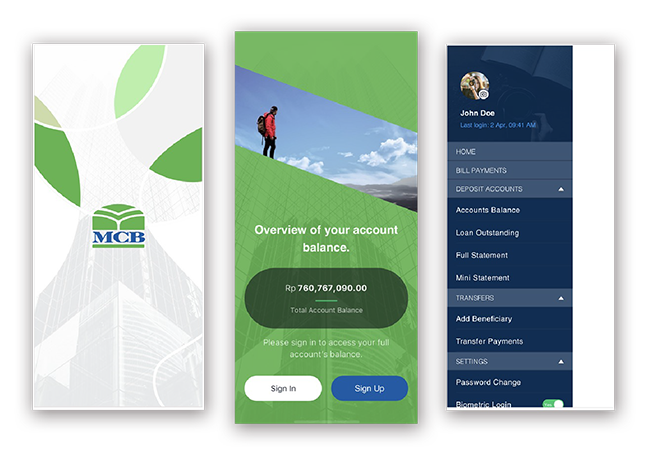

Mobile &

Internet Banking

Customer Relationship

Management (CRM)

Branch Delivery

System (BDS)

Branchless

Banking

Trade &

Payments

Biometric

Enrollment (eKYC)

Loan Origination

System (LOS)

Revolutionize your digital banking solutions. Just like they did.

Find out how Neutrinos Low Code Platform transformed the banking journey for some of the leading banks across the world.

Retail Digital Banking

For UAE’s fastest growing NBFC, Neutrinos insurance automation software implemented full service digital onboarding solutions with web & mobile applications at customer contact centers in Phase 1 and back-office transformation in Phase 2. Payments, cards or loans? We’ve got everything covered.

- D2C Mobile Banking Credit Card, Loan and Account Onboarding & Self Service

- Mobile Responsive App & Content Framework (Others, My Products, Preferences)

- Reporting on Digital Banking Mobile and We App Activities

- General Customer Self Service (FAQ, Contact Us, etc.) Instant notifications of account transactions

- Smart messaging and reminders. Mobile help desk and chats for customer support

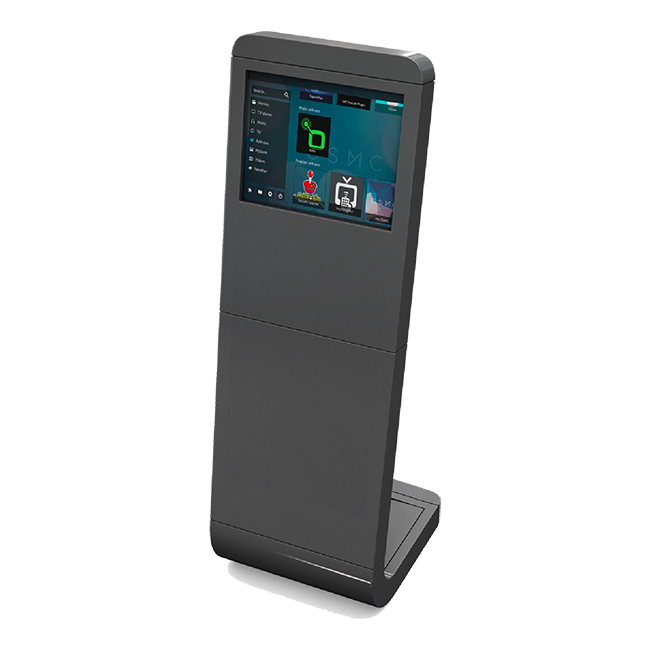

The Key to Kiosk Management

Neutrino Low Code Development Platform helped a full-service digital bank in South Africa complete banking transactions and payment card issuance via kiosks equipped with our intelligent document processing software, installed in retail outlets within weeks. With remote health monitoring for the kiosks and automated as well as guided remediation, the bank was able to prevent failures and outages before they occur and reduce the cost of kiosk operations.

Printing

Remote

Dashboard

Biometrics

Integrated Scanners

Remote system

Monitoring

Application

Interface

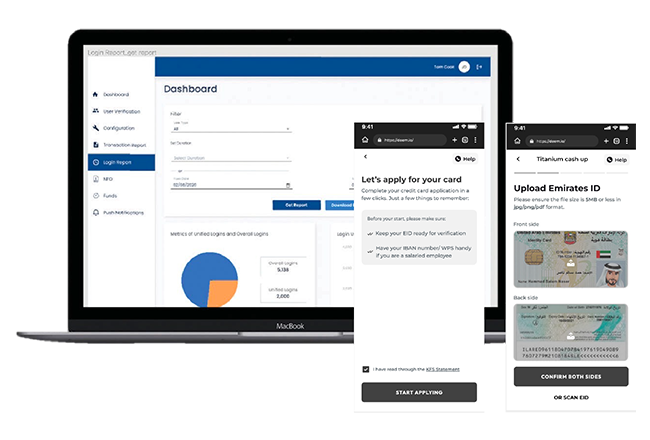

Credit Scoring System, Merchant Onboarding

Credit Scoring and Referral:

With the introduction of the FIC Amendment Act in South Africa, the bank was forced to implement this rule within 2 months. Neutrinos low code platform successfully implemented a digital onboarding solution on time, with KYC and background verification capabilities.

Wealth management

Home loans origination system

Merchant Onboarding:

- Opening new POS account, case management for POS installation and setup

It’s all about being Progressive.

Mobile customer portals for basic account data

Mobile lead capturing and promo apps for new clients

Instant notifications of account transactions

Smart messaging and reminders for dues, dates and amount

Mobile help desk and chats for customer support

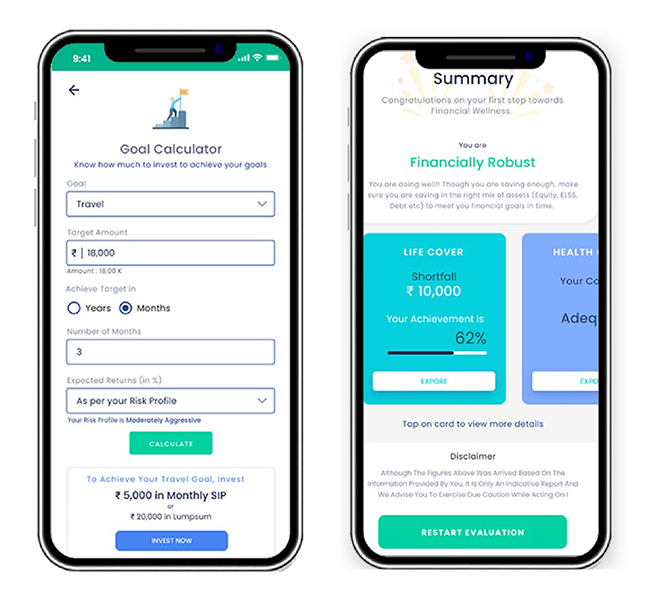

Smart Banking, at your fingertips.

- The Wealth App integrates into multiple banks & insurance systems to provide numerous dimensions for the customer to plan their savings, investments, and insurance.

- It recommends the top funds to the customers and allows them to switch and redeem the funds at any time.

- Customers enjoy clear visibility about the invested fund performance by highlighting the fund distribution.

- The Wealth App covers Child Education, Life Covers, Health Covers, Loans, Emergency, and Retirement Funds.

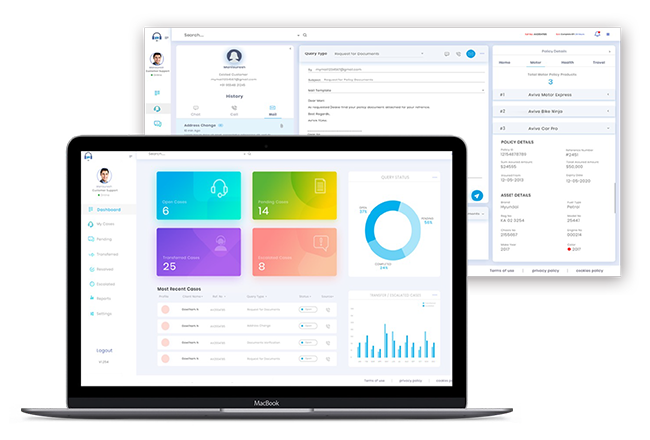

Keeping customers happy, at every step.

With Neutrinos low code API integrations, developed a client onboarding banking application to automatically gather customer queries coming from multiple sources, such as email, call center, social media, and WhatsApp, and resolve them within a single interface. The app was able to automatically classify the query and create a ticket, assigning it to relevant functions or departments, and provide timely assistance.

- AI: Integration to analyze the patterns of churn and help upsell customers on new products and services

- Chat Bot: Integration into custom built or 3rd-party chat bots for intelligent self service

- IVR Integration: Automatically load customer profile and data once the caller is identified, and launch satisfaction surveys once the call is over

- Case Management: Resolve cases quickly by providing agents with full context of the relevant case

- Customer Service Agent Portal: Displaying the customer portfolio, products, & transactions with the bank for a 360 view of the customer & their satisfaction level with different touch points

- Operations: Performing operations on behalf of the customer such as payments, transfers, setting up standard instructions

- Complaints Management: Capturing customer complaints, following up and routing to concerned teams