These global innovators grew with us

You can too.

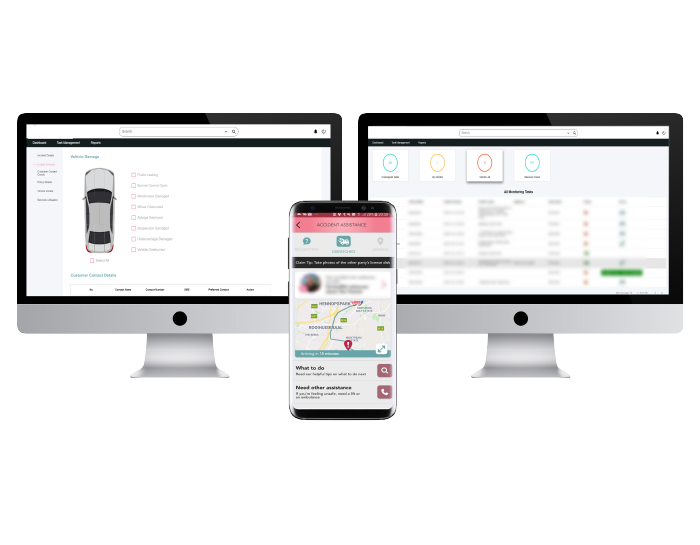

With a partner that helps you

Turn your Digital Dreams

into Reality

with unique design thinking and technology building blocks.

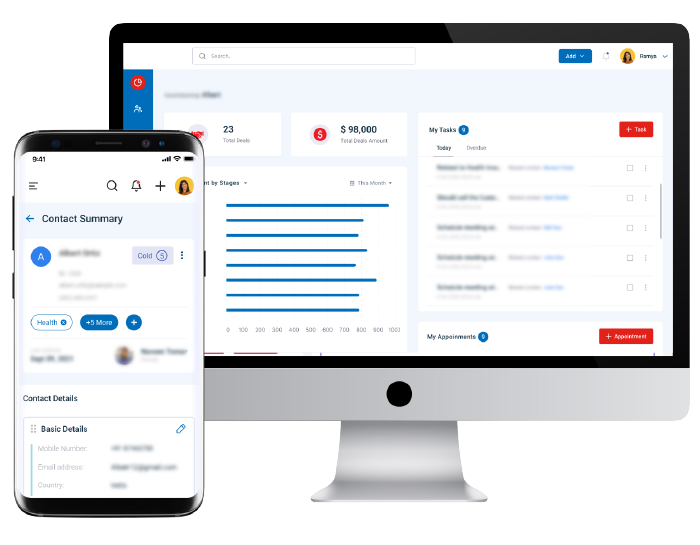

Dream Big and Transform

Business Incrementally

with de-risked and trusted approaches.

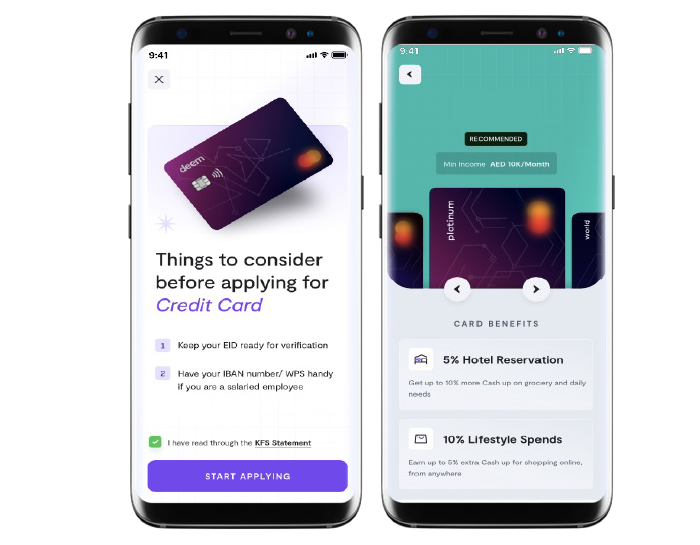

Revitalize ROI and Boost

Customer Retention

with Neutrinos Infinity Composer.

Achieve Limitless Potential

with a Global Ecosystem

of top-tier vendors and transformation programs.

Just like these inspiring stories did

At Neutrinos, we empower your success by bringing your digital aspirations to life and championing a culture of prosperity that delivers business value across categories.

Enter the Neutriverse of imagination

And grow further with our partners

We don’t just keep great company. We also help others at it!

It’s not just our customers, but our partners too!

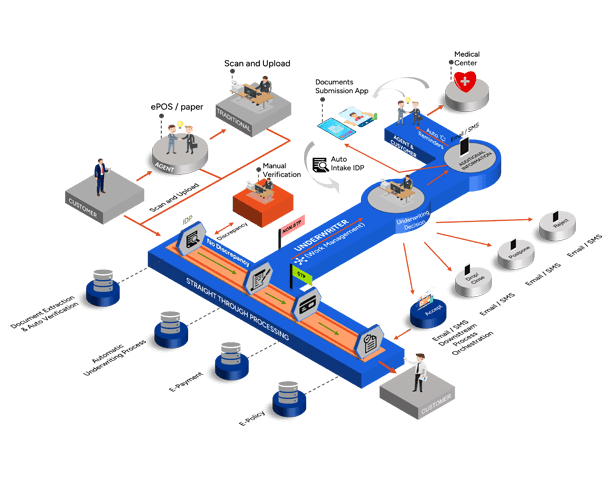

Our ecosystem is home to many stories of businesses reimagining their digital footprint with our fast and efficient deployment capabilities.

Discover what’s NEU at Neutrinos