The Submission

The Issue at Hand

Customers feel anxious while

submitting claims

Every claim begins and ends with the customer. It is important that the insurer secures the customers peace of mind at every step of the claim journey.

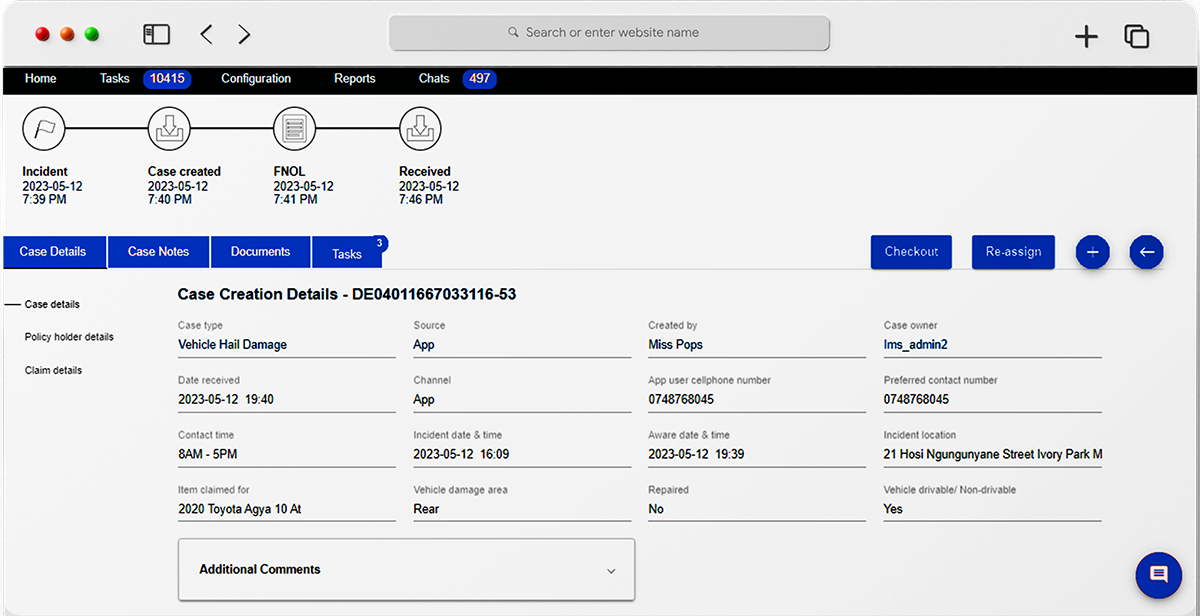

The process of manually submitting documents while trying to contact an agent to navigate through the claims process can be challenging. Moreover, re-living the incident while making a claim makes it a stressful ordeal for the customer.

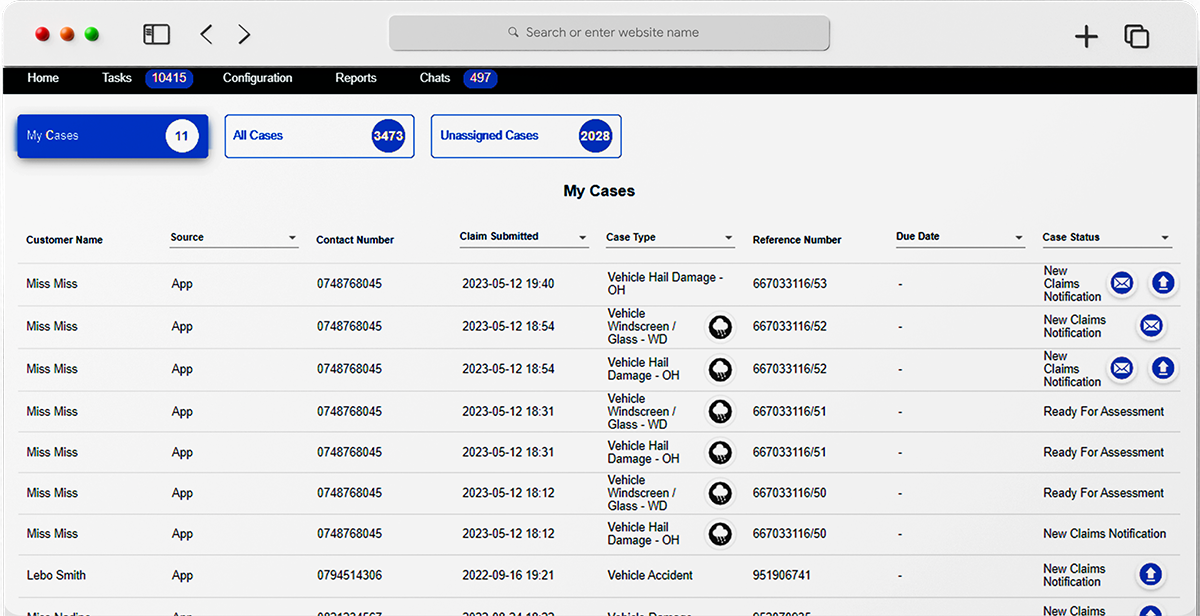

At the agents end, sorting through a multitude of claim documents to find the information needed to register a claim, while guiding the customer through the claim journey can slow down the submission process.

The Neutrinos Advantage

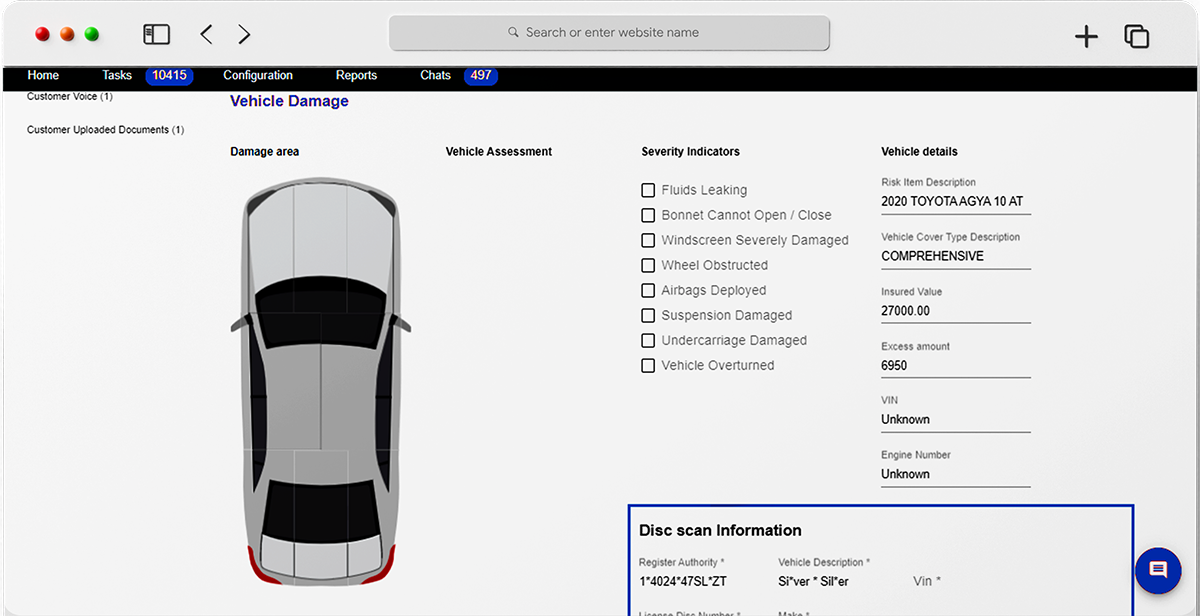

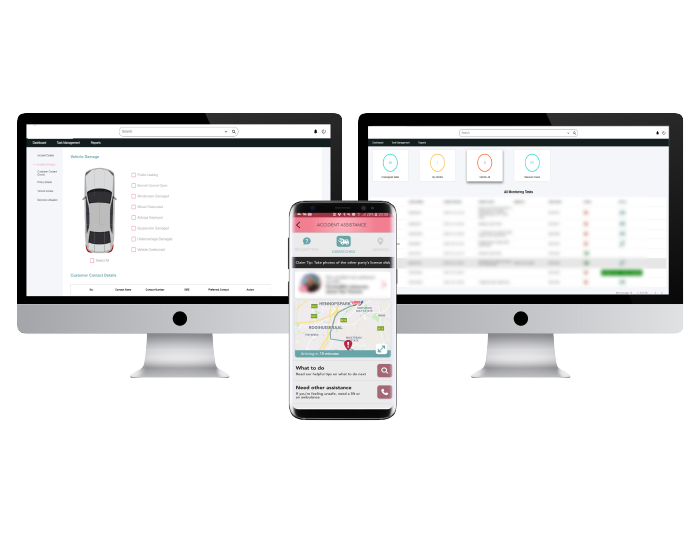

Let customers take control with intuitive submission & OCR capabilities

The Neutrinos Claims Management Software’s low code automation makes it easy for the customer to submit documents digitally without any intimidating insurance parlance.

With the means to track eligibility and status of claims at any given time, at their fingertips, customers can bypass talking to agents and take control of their claim settlement process.

The OCR capabilities of the insurance claim management software automatically extracts relevant information from a wide array of documents within minutes and consolidates it all together for faster processing.

The Verification

The Issue at Hand

Medical officers are overburdened

with admin tasks

The agent then passes on the documents to a medically qualified officer. While this person is expected to adjudicate the eligibility of a claim, the manual, laborious nature of the task can result in delays in claim processing.

The medical officer must check the documents submitted with intense scrutiny. Worse, they not only have to check everything from a medical point of view, but they are also burdened by administrative tasks, which is not their domain of expertise.

In addition to deciding if a claim is eligible for a pay-out, they also have the added responsibility of deciding how much to pay.

The Neutrinos Advantage

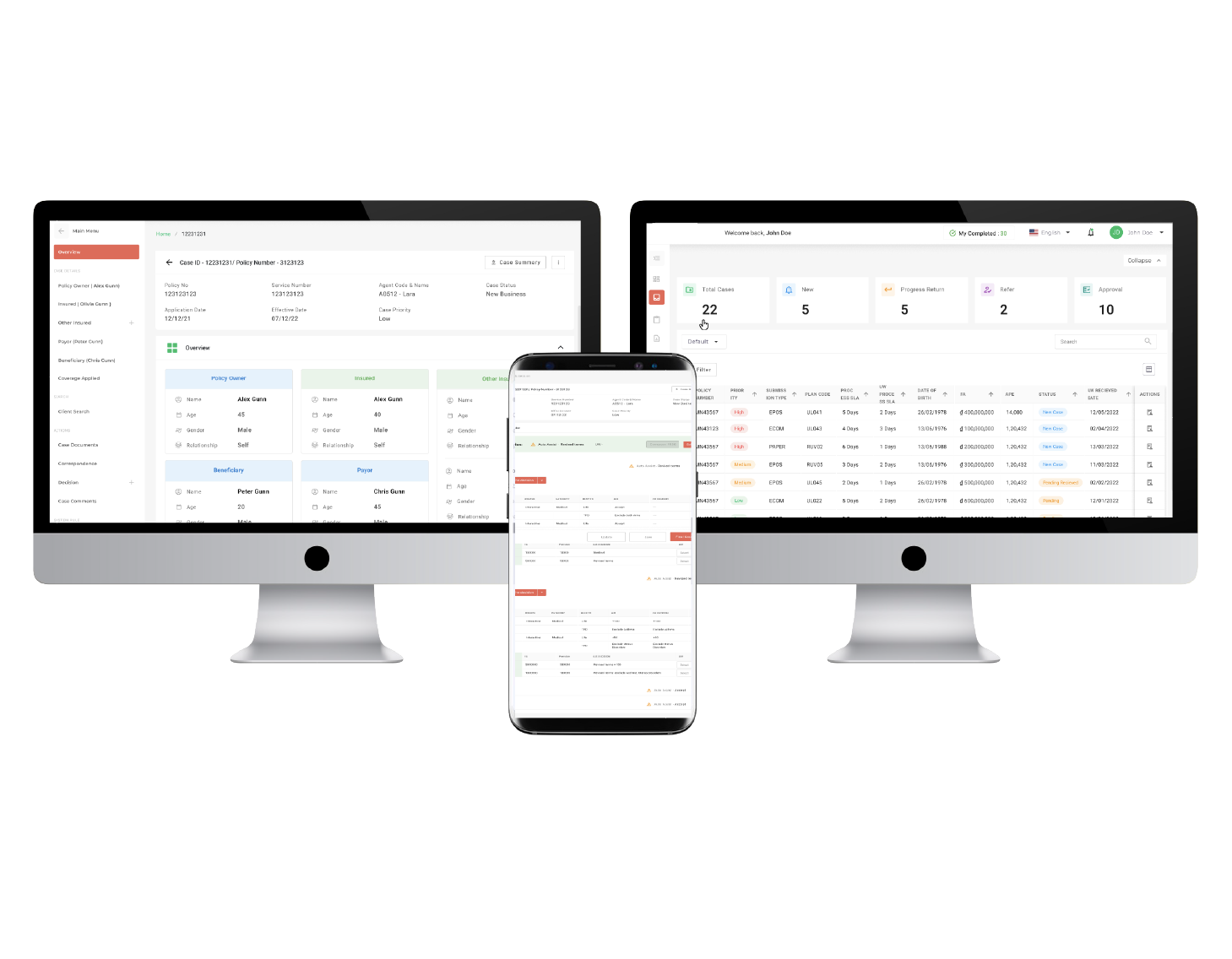

Simplify administration with automated eligibility checks & payout determinations

The Neutrinos health insurance claims management software can extract information from new documents, aggregate information from existing ones and then consolidate them to support the new claim.

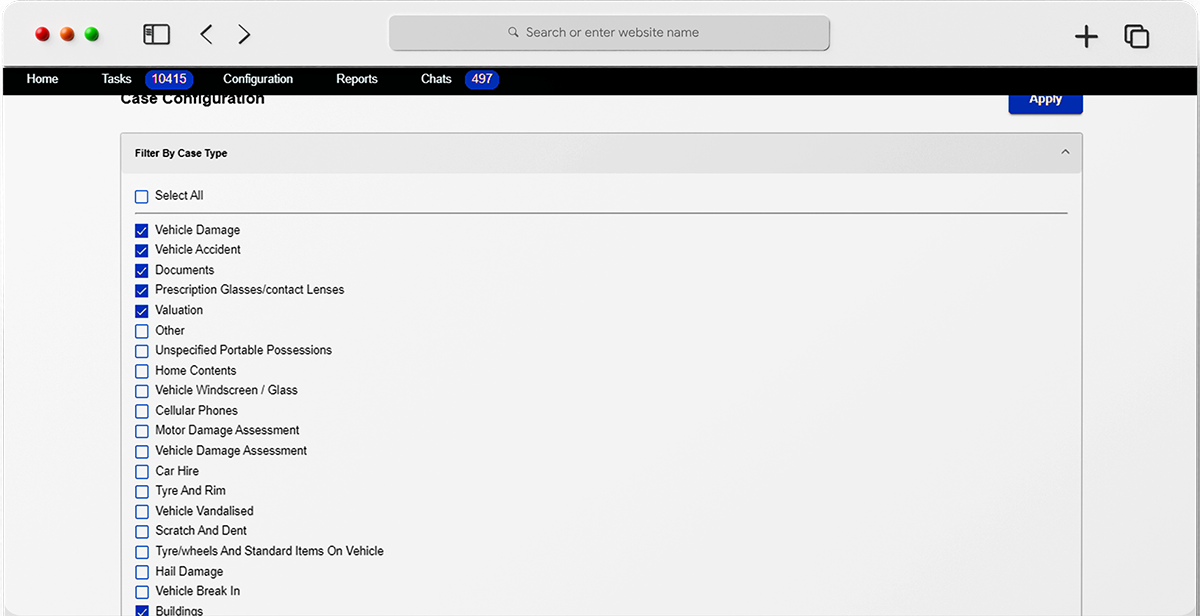

Aside from determining the eligibility of the claim and the final pay-out, the low code software also determines when a medical officer’s intervention is required to confirm the diagnosis for more complex claims.

By removing these administrative dependencies, medical officers can now focus on just delivering their expert judgement and customers can be assured of an efficient process.

The Investigation

The Issue at Hand

Insurers need to identify fraudulent claims

& investigate without bias

Transparency is key in insurance claims. Customers should not feel that the decision taken has been influenced by any prejudice while insurers make sure that a claim is not fraudulent.

For this, insurers need to maintain a keen eye for detail and conduct investigations free of any personal bias. However, the process itself is long and can become redundant without the right sets of data.

If insurers are not able to control fraudulent practices, customers would be burdened with increased premiums and may also leave themselves more vulnerable to risks.

The Neutrinos Advantage

Protects customers & insurers with intelligent pattern recognitions

The Neutrinos insurance claims management algorithm is designed to analyze patterns and behaviors and determine if any of them may result in possible fraud or risk.

The insurance automation software will scan patterns in terms of frequency of claim, nature of the claim, and also data about the person and their background to determine if the claim is fraudulent.

By building these capabilities into the system, insurers can simplify the tedious process of claim verification and assert their credibility.

The Communication

The Issue at Hand

Customers feel uninvolved

or ignored in the claims process

Unlike online shopping, the systems and processes in insurance are unfortunately not built to provide clear insights about the status of a customer's claims.

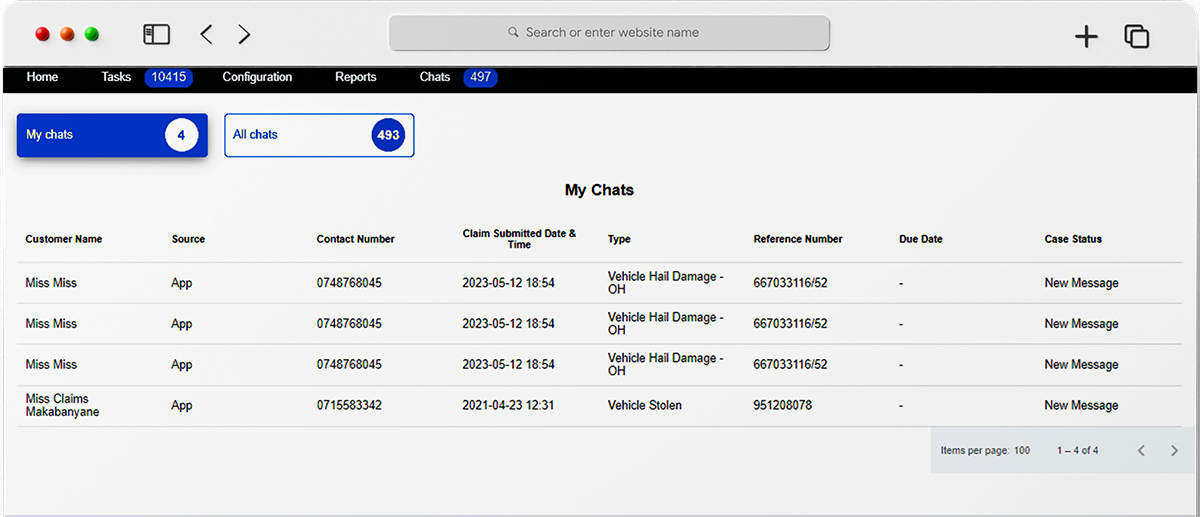

Communication between customers and insurers is also broken. Sometimes, a customer may be unclear on the details required and will have to wait days before they can get a call from the insurer about their claim’s status.

This lack of transparency is a result of archaic technological integration and can result in customers becoming frustrated and insurers losing credibility.

The Neutrinos Advantage

Build trust through transparent online communication

The Neutrinos Low Code Development Platform helps integrate Communication Module allows insurers to monitor all email correspondence with internal and external stakeholders from within the platform.

By adding this layer of transparency and efficiency, customers enjoy more open communication with insurers and can feel assured that their claims are being processed meticulously.

The Settlement

The Issue at Hand

Outdated payment methods have been

slowing insurers down

Finally, we move on to the claims settlement and payment resolution. Insurers in the 21st century still depend on outdated payment methods to disburse money - either through manual bank transfer or checks.

Those that do use digital payments find that the process can be time consuming when trying to transfer the data to their banking systems.

Most insurers lack the technology to do instant integrations and thus, cannot avoid the excessive effort needed to build modern day capabilities on legacy platforms.

The Neutrinos Advantage

Combine legacy platforms with modern tech through easy integration's

The time taken from when the claim settlement communication reaches a customer till the point the final settlement amount reflects in their bank account can be dreadful.

Insurers can get rid of this waiting period while offering a pleasant experience for the customers by integrating modern digital payments technologies onto their legacy insurance claims automation software.

The Neutrinos insurance claims software is designed to facilitate instant integration via low code APIs that avoid having to build capabilities over and above pre-existing legacy platforms.