The Submission

The Issue at Hand

Branch operations staff must

manually input data

Insurance branch offices deal with a huge volume of applications in a single day, which the operations staff must scan, order, and clean up information in preparation for data entry.

When agents bring in applications to the branch, the staff must manually input the various data collected which becomes a tedious and resource intensive process.

To top it off, agents spend time visiting branches instead of utilizing the time to serve customers.

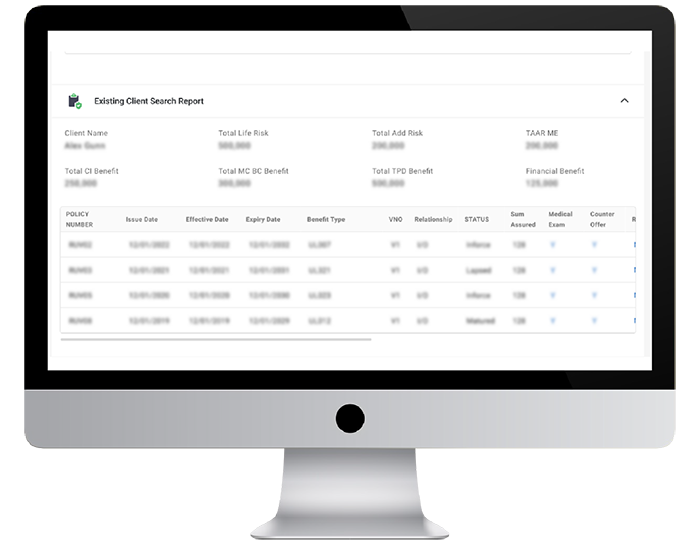

The Neutrinos Advantage

Streamlines Document Processing via AI enabled document sorting

Neutrinos business underwriting software enables customers to scan & upload documents with ease through built-in OCR and ML capabilities.

Thus, automatically capturing and collating all the information into a single dashboard for seamless document management.

Through automated document processing, insurers can free up agents from intensive and repetitive tasks, while improving new business underwriting quality and turn around time.

The Verification

The Issue at Hand

It takes time and resources to

verify individual documents.

Once applications have been submitted, there can often be delays in document verification because of the time it takes to investigate.

Secondly, when operations staff are overloaded with documents they may miss errors, omissions or inconsistencies in information it adds to the underwriting cost and risk.

Underwriters must also identify signs of fraud and decide what further verification or investigation steps should be taken.

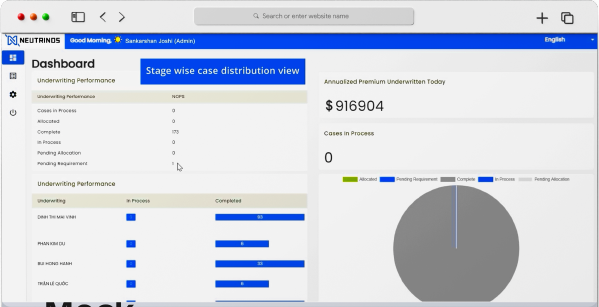

The Neutrinos Advantage

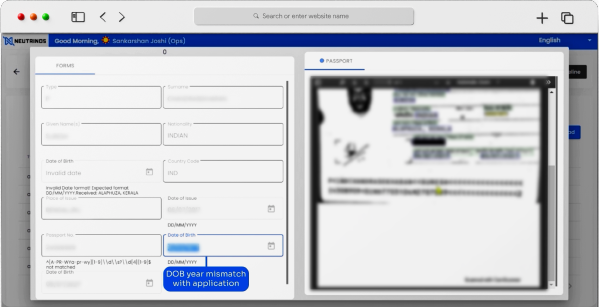

Error-free and optimized verification with automated underwriting

Neutrinos’ insurance underwriting software is per-trained on common insurance document types and uses a set of automated rules based on which it can scan and automatically verify the information.

The insurance application software algorithm assesses case eligibility for straight through processing and auto-assigns an agent in case manual intervention is required.

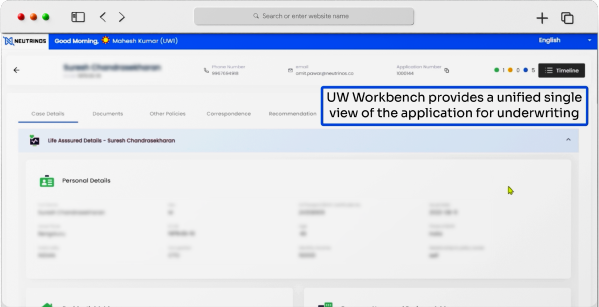

The digital underwriting insurance solution assigns and delegates jobs to underwriters based on their skillset and experience to optimize resource utilization.

The Data Audit

The Issue at Hand

Alerts cannot be tracked, and

communication is broken

When underwriters require additional information, they generally need to correspond with the agent or customer. Often, they lack tracking mechanisms to check the status of these inquiries.

When documents are pending, it takes multiple reminders done in tedious and long-winded process of underwriter to agent to customer and then vice-versa.

Agents may even be required to travel to the respective branches in person, or via courier, to collect certain sets of data which causes significant delays.

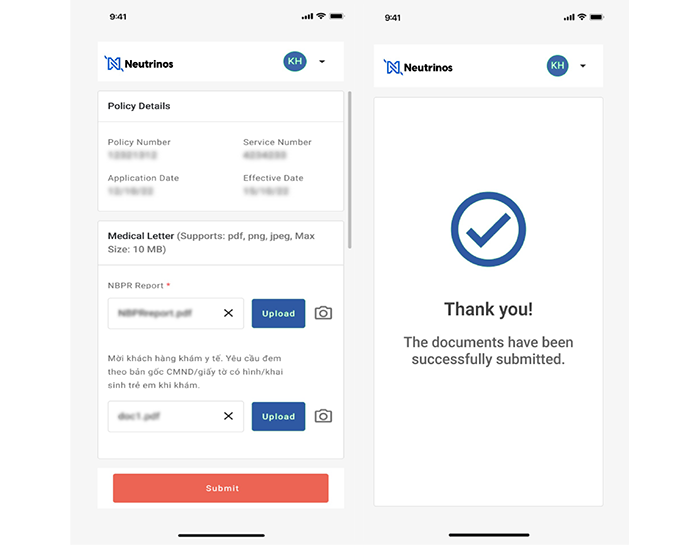

The Neutrinos Advantage

Timely communication with auto-alerts and 24x7 status tracking

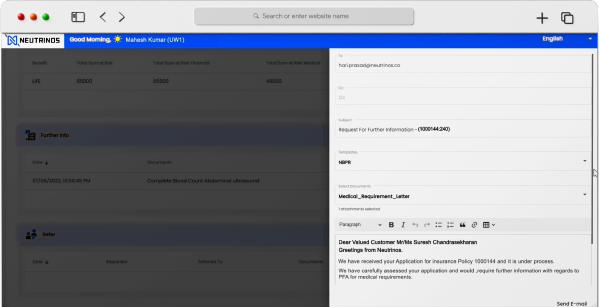

With Neutrinos insurance application software, agents can now enjoy real-time correspondence on missing requirements and can supply it digitally without having to visit the branch.

A regulated dashboard on the underwriting workbench allows companies and its underwriters to get a 360-degree view of the all the inquiries and track real-time document validation and alerts, remotely.

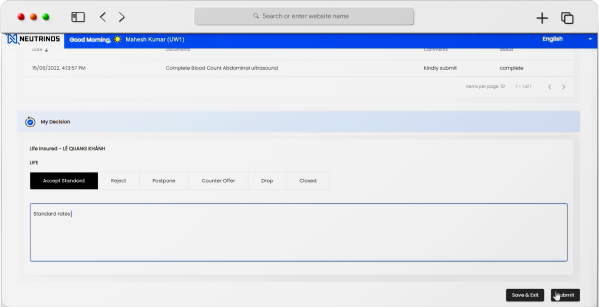

The Decision

The Issue at Hand

Insurers need to identify fraudulent

applications & investigate without bias

Customers may feel like the decision taken is biased and insurers experience heightened risk due to fraud and leakage.

For this, insurers need to maintain a keen eye for detail and apply good judgement. However, this depends on underwriters following the rules in place with appropriate due diligence.

Underwriters have a greater cognitive burden, making their jobs more stressful and tedious. If insurers are not able to bring rigour and control fraud, they leave themselves more vulnerable to risks.

The Neutrinos Advantage

Protects insurers with rule-driven comprehensive underwriting

With Neutrinos insurance underwriting software, insurers can be confident that underwriting is compliant and free of bias before the ultimate decision is taken.

In most cases, straight-through underwriting eliminates manual errors and omissions and turns around applications in minutes, with high accuracy.

Even in complex cases requiring manual underwriting, Neutrinos low come integrations can provide data and insights to guide the underwriter for speed and compliance.