Lead Generation & Management

The Issue at Hand

Limited access to crucial customer data impedes

agents' ability to close sales effectively

Agents need access to an efficient distributor management software so they can work on active leads effectively. Without this, they end up spending time on stale leads that waste time and cause other high-quality leads to be missed out.

Once an agent picks up a lead, they must find out background data such as prior interaction notes, existing policies, or claims, etc. Without this data, they would be severely limited in their efficacy in closing a sale.

The Neutrinos Advantage

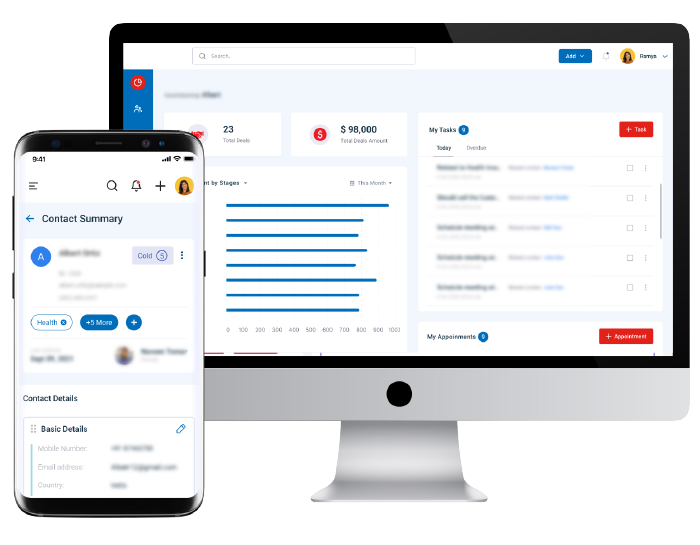

Agents can seamlessly source, curate, and manage leads with real-time updates

The Neutrinos Insurance Distribution Software provides a full-fledged lead management capability that covers lead sourcing, aggregation, lead lifecycle management and more.

Leads can be sourced from CRM systems including Salesforce, or directly entered in the application. Updates are captured and distributed in real-time.

The insurance distribution system keeps track of lead freshness and raises timely interventions and escalations to prevent leads going stale.

Prospect Interaction

The Issue at Hand

Agents find it difficult to manage

prospect meetings and communication

Agents need to organize their calls and visits with prospects while managing the availability, meeting preferences, their own calendars, etc.

For customers who prefer voice or video calls, the agents need to surf between devices to make the calls, and then manually update interaction status and notes in their records.

The Neutrinos Advantage

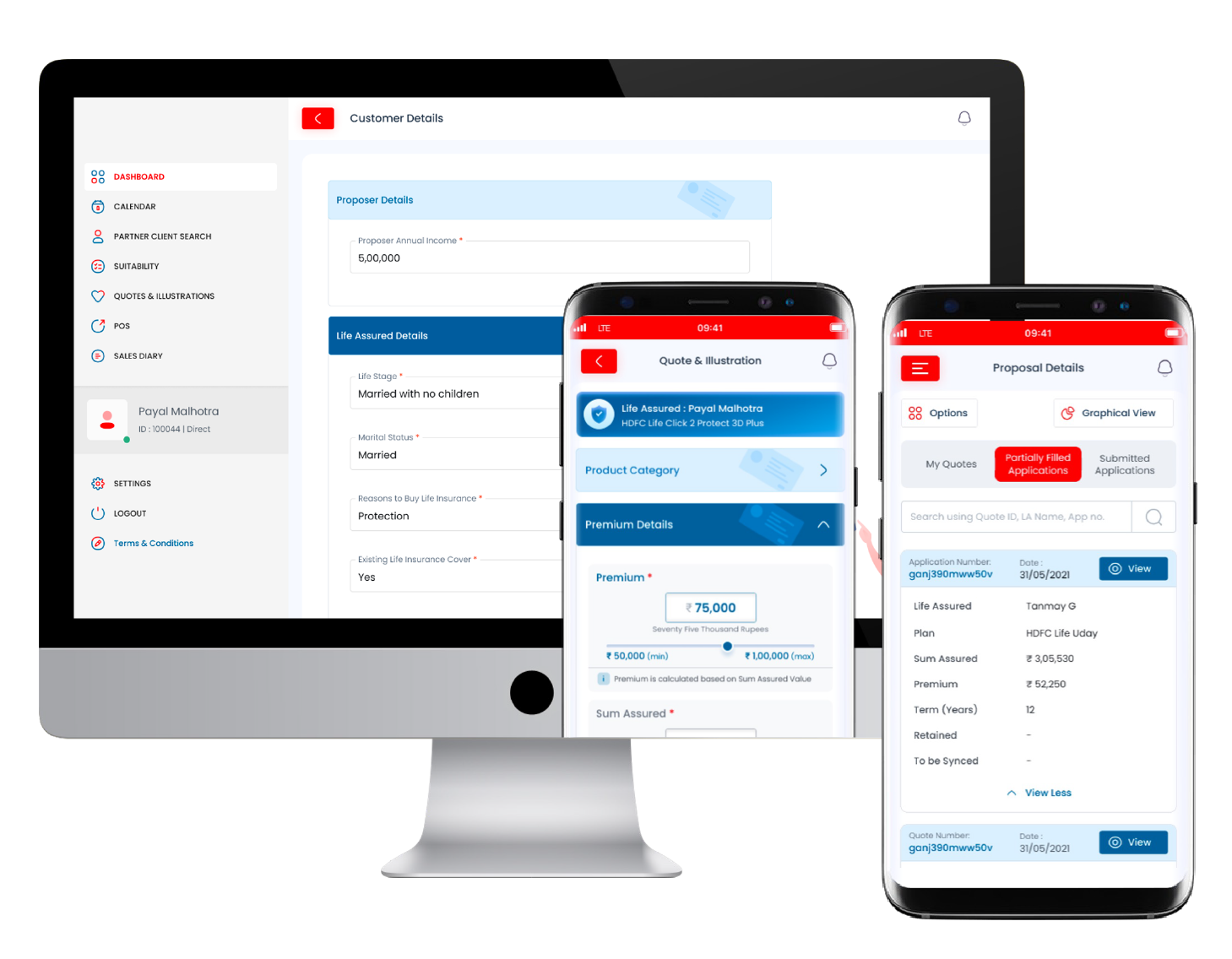

Centralized scheduling helps agents keep prospects engaged

With Neutrinos insurance distribution management software, agents have scheduling, meeting and note-taking tools all organized in one place, at their fingertips.

No more missed meetings, scheduling bloopers, or failing to meet on prospects’ preferred channels. And all prior notes are available right where the agent needs them.

Agency Performance Management

The Issue at Hand

Inefficient agency management using outdated

methods and manual processes

Setting up and managing agencies can be complex. The insurance company administers the agent recruitment, onboarding, and offboarding, training, etc. Tracking these processes using emails, spreadsheets, and the like, is slow and error prone.

In addition, the agency setup, including commissions planning and tracking, performance monitoring at agency and agent level, and taking remedial actions where needed, are an additional set of complex administrative tasks.

The Neutrinos Advantage

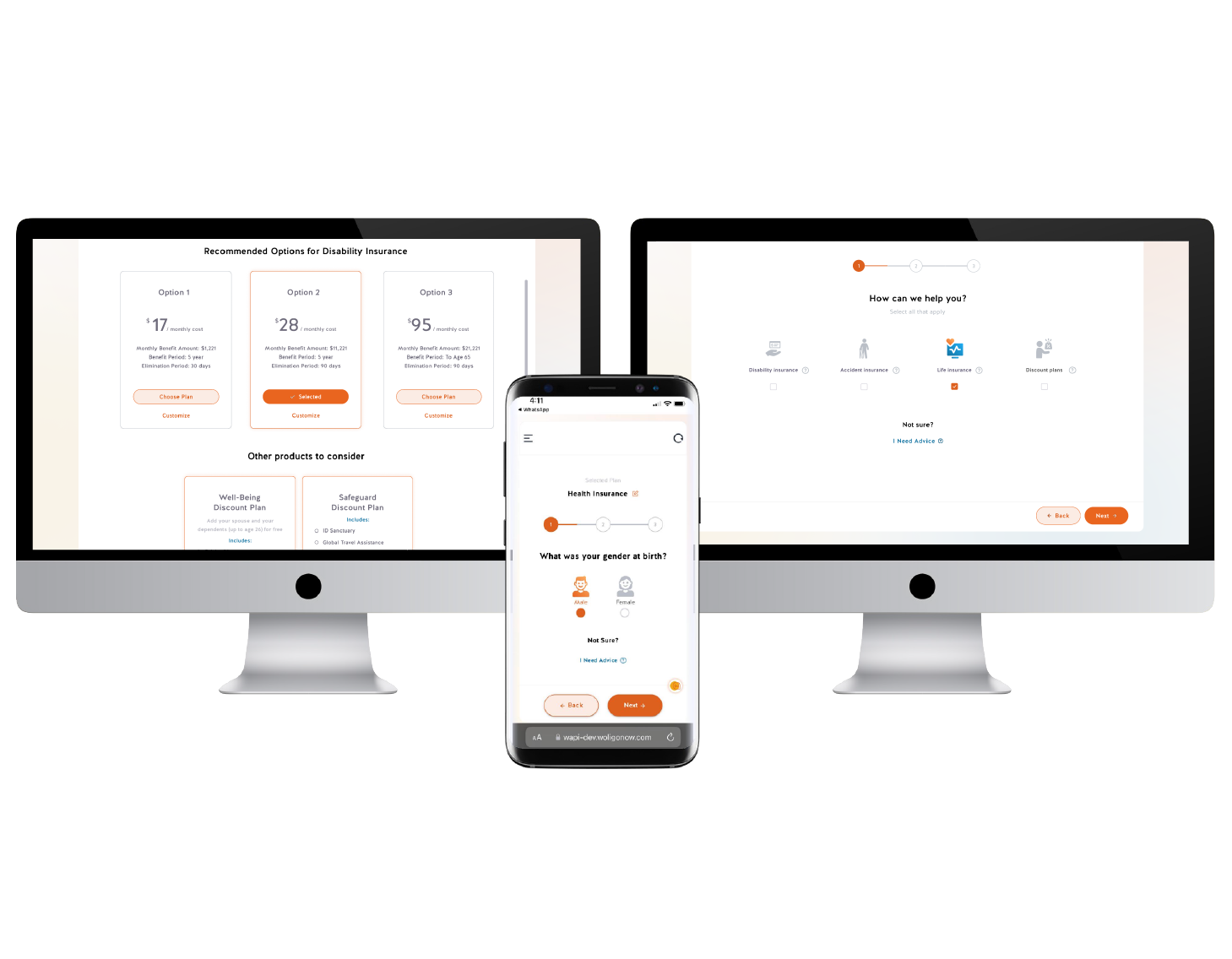

Transform agency operations with end-to-end agent management

With Neutrinos Low code automation you can truly experience what is distributed management by setting up agencies and agent networks is a breeze. The insurance distribution solution takes care of agent recruitment, onboarding, training, and KPI monitoring, triggering automated actions based on KPIs.

Agents get access to all they need to be effective: learning and knowledge, product information and collateral's, dashboards to monitor own and peer performance, and gamification tools to encourage desired outcomes.

The result? 4X greater agent productivity and job satisfaction.