The Ultimate Guide to Claims Management Software (2023)

Author:

Dr Hari Prasad, Insurance Practice Head - Neutrinos

All claims’ journeys start and end with the customer. Hence, it is crucial for insurers to provide an environment where consumers can submit, track, and receive claim settlement payments through a unified platform.

A Claim management software enables insurance companies to showcase their consumer first digital approach by simplifying the end-to-end process of claims management, while freeing up essential resources that can be allocated to other key business areas.

In this guide we dive into the key features and benefits of claims management software. and things to look for when choosing a claims management software.

What is a Claims Management Software?

A claims management software enables both the customer and the insurance provider to manage their claims journey from a unified platform.

A claims management software enables both the customer and the insurance provider to manage their claims journey from a unified platform.

On the customer’s front, a claims management software allows them to submit claim related documents easily and get instant updates on the status of their claims, as well as get in touch with their insurance providers in case any help is needed.

Whereas, for an insurer, a claims management software brings all case details under one roof and offers a bird’s eye view of all cases for simplified claims processing.

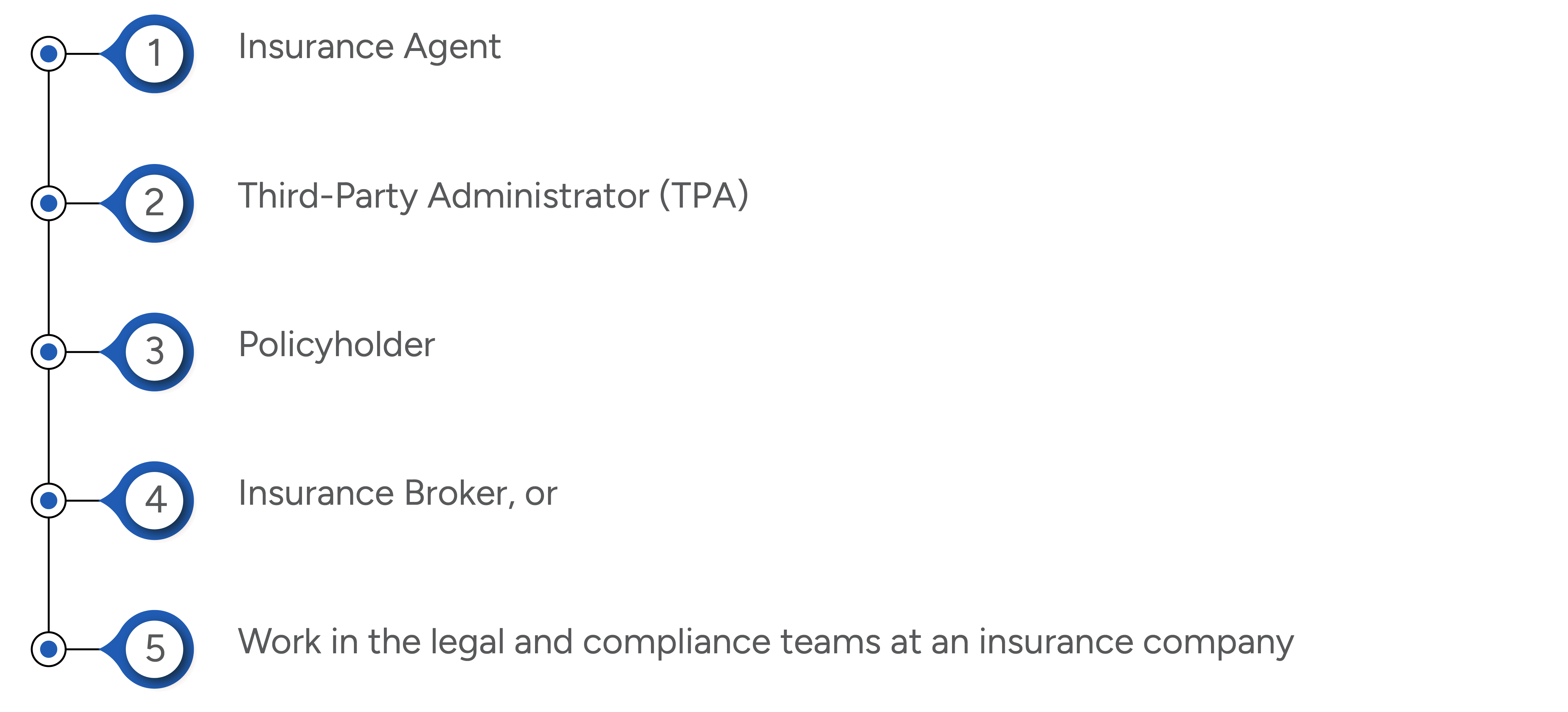

If you are :

You should be using a claims management software.

Key Features of Claims Management Software

Claims management solutions come in a lot of shapes and sizes depending on the users needs.

Below are some key features that a claims management software should have, to support day to day operations of an insurance provider.

Claim Intake Wizard

A claims management software simplifies the claim submissions process by gathering relevant information from multiple sources and consolidating it to a centralized database for seamless case management.

Payment Processing

Insurers still depend on outdated payments and banking systems that slow down the claim settlement process. A claims management software provides modern banking and payment modules that can help insurers boost straight through processing of claims and settle claims in minutes.

Process Management and Automation

A claims management software automates repetitive processes and assigns agents automatically wherever manual intervention is needed for faster resolution of cases.

Predictive Data Analytics

The process of claim settlement involves vast amounts of data flowing through multiple systems. A claims management software offers data analysis and visualisation tools to facilitate data-driven decisions.

Efficient Customer Communication

A claims management software answers customer queries, and sends out updates, as well as involves a customer representative as and when needed for efficient customer communication.

API Integration Capabilities

A claims management software enables seamless integration with other enterprise solutions to facilitate holistic business performance management for an insurer.

Document Processing & Management

A claims management software enhances the documentation process across the claims journey, through intelligent document processing and automated character recognition for scanning unstructured data.

Regulatory Compliance Management

A claims management software ensures compliance with rapidly changing government laws and regulations to help insurers avoid compliance discrepancies.

Fraud and Risk Assessment

Insurers loose more than $40 Billion every year in the United States alone to fraudulent claims. A claims management solution offers risk assessment and fraud detection capabilities through pattern recognition and data analysis to reduce fraud related losses.

Benefits of Claims Management Software

Some of the key benefits of a claims management software for insurance providers are:

Faster Case Resolution

One of the key benefits of claims management software is scalability of business through faster case resolution and reduced operational costs.

A claims management solution can automate workflows and resolve bottlenecks in the claims process, boosting touchless claims processing, while reducing manual intervention of agents at the front as well as back office.

Unified Case Management

A claims management solution provides a unified dashboard to manage all cases, along with relevant claim details.

This helps insurers resolve customer queries, and proactively address any blockages to settle claims faster.

Automate Claims Processes & Reduce Human Error

Claim intake, document processing, FNOL registration, adjudication and finally payments approval, are the key steps in the claims journey.

A claims management software can efficiently automate workflows across the claims journey while reducing human error.

Centralized Data Storage & Management

A claims management software facilitates database management by automatically storing and organising all case data to a single database.

Insurers can access this data to perform data analysis and track business performance right from the claims management solution.

Improved Fraud detection & Regulatory Compliance

Fraud recognition and regulatory compliance are among the most important benefits of a claims management software for an insurance provider.

A claims management solution can recognize patterns and detect fraudulent claims by analysing large sets of customer data.

Efficient Decision Making

A claims management solution offers a single dashboard for all case data along with data visualization tools.

Thus, improving the quality and efficiency of business decisions, while significantly reducing time taken for data analysis

Enhanced Customer Experience

A claims management software provides a simplified claim intake process for the customer and enables insurers in offering prompt customer communication regarding their claims status, thus enhancing customer experience.

5 Things to Look for When Choosing a Claims Management Software

The process of choosing a claims management software can be quite challenging for insurers.

Here are 5 key things to look for when choosing a claims management software:

Business Needs

Different insurers have different products, deployed in different markets. Therefore, every insurer will have unique needs when it comes to a claims management solution.

Having clear understanding of business requirements can smoothen the process of choosing a claims management software significantly.

Integration Simplicity

Insurers need to integrate the data from the claims management software to other systems like, CRM, CMS, accounting, and business intelligence systems.

A claims solution that allows easy integration to other systems can help with the scalability of business for insurers and facilitate data-driven business decisions.

On premise or Cloud Based Deployment

Claims management software come in two different deployment formats, a traditional on-premises software, which can be installed on computer systems and an on-cloud or a SaaS (Software-as-a-service) deployment method which can be accessed through a web browser.

While a traditional software offers complete control to insurers, a cloud-based software offers more customization and flexibility options to the users.

Customizability

Be it integration with other systems, or modifying the dashboard, a claims management software that can be customized to the users' needs, can maximize the value it has on the business for an insurer.

Cost of Claims Management Software

Due to the intricate nature of the software and complexity of features, a claims management software comes in a wide variety of price points. From a few hundred bucks a month to a thousand dollars.

Some key considerations to look at when negotiating the cost of a claims management software as its key capabilities, pricing models, and return on investment for the insurer.

Summary

A claims management software can prove transformational for an insurer across their value chain when it comes to offering a seamless customer experience. With a market value of $36.3 Billion in 2021, and 8.4% CAGR, the adoption rate of claims automation software is increasing rapidly.

Insurers need a partner that can provide end-to-end claims digitalization solutions with future-ready tech capabilities such as Gen-AI, Data Modelling, Cloud Native, API led solutions that offer complete autonomy over the software.